For years, Google Discover was a gift to publishers. A high-volume, intent-rich feed where strong headlines, timely reporting, and smart distribution could unlock millions of incremental clicks.

That era is ending.

New data from Marfeel Discover Monitoring, shared by Xavi Beumala (Founder & CEO at Marfeel), confirms what many publishers have felt anecdotally for months: Google Discover is no longer a publisher-first channel. It’s becoming an AI-first product designed to keep users inside Google’s ecosystem.

This isn’t a tweak. It’s a structural rewrite.

And if your growth model still treats Google Discover as a dependable traffic engine, you’re standing on melting ice.

Google Discover’s big shift: from traffic distributor to attention controller

Let’s take a look at the data.

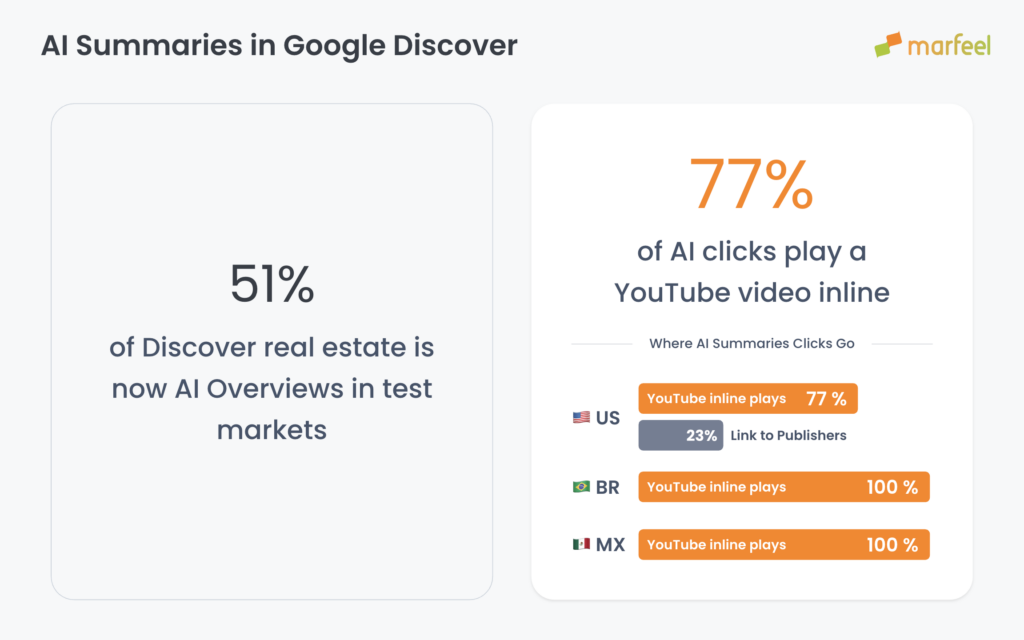

Across the US, Brazil, and Mexico, 51% of Google Discover feed entries are now AI Summaries. Not experiments. Not edge cases. Half the feed.

These summaries:

- Aggregate multiple publishers

- Show several logos (creating the illusion of attribution)

- But offer one default content to click to

And in the US, this is brutal for publishers:

- 77% of AI Summaries play a YouTube video inline

- Only 23% link to a publisher

- In Brazil & Mexico: 100% of AI Summary exits go to YouTube

Visibility without traffic. Presence without payoff.

This aligns with the broader pattern we’ve been tracking across AI Overviews and AI Mode: Google is optimizing for engagement retention, not outbound clicks.

Google Discover isn’t ranking content anymore. It’s orchestrating attention.

Where AI is taking over (and why that matters)

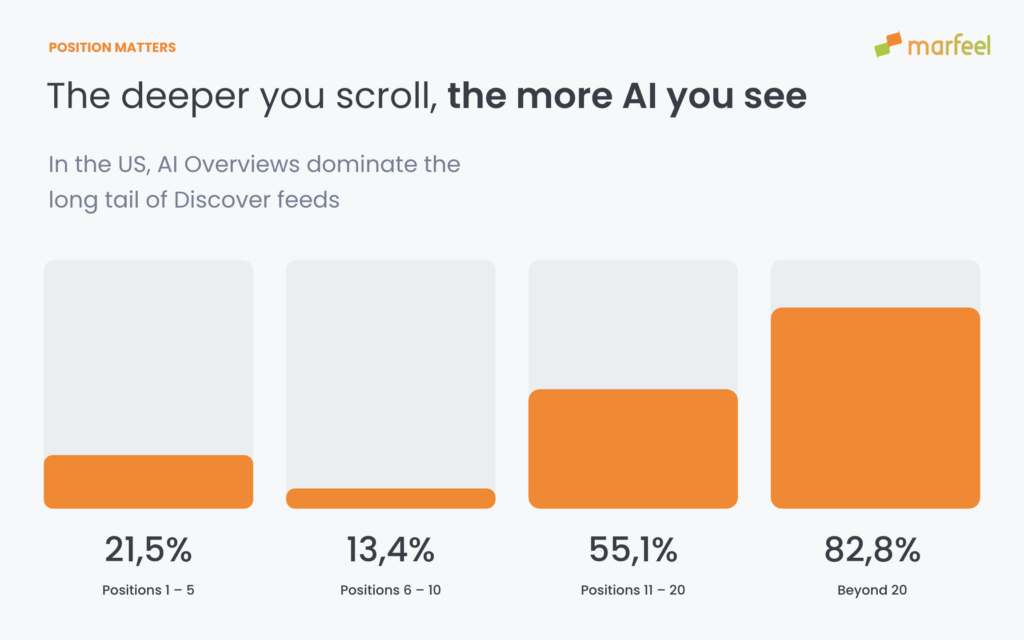

AI Summaries aren’t evenly distributed.

In the US feed:

- Positions 1–5 → 21.6% AI

- Positions 6–10 → 13.9% AI

- Positions 11–20 → 56% AI

- After position 20 → 82.7% AI

This is a classic rollout pattern:

- Start deep in the feed (low visibility risk)

- Measure engagement

- Move upward if metrics hold

The implication is obvious: the long tail of Google Discover is already AI-first. Volume exposure is being squeezed from the bottom up.

And once AI proves it can outperform links on engagement? It won’t stay in the back of the feed.

The real winners: YouTube first, X second

This isn’t just about AI. It’s about internal distribution.

YouTube

- Absorbs a disproportionate share of Google Discover real estate

- Becomes the default content in AI Summaries

- Especially dominant in emerging markets

Google Discover is quietly evolving into a video-forward, AI-curated feed. If you don’t produce video, or don’t own the channel, you’re funding someone else’s growth.

X (Twitter)

- Appears frequently

- Mostly in lower positions

- Low individual visibility, high aggregate presence

X floods the feed but rarely dominates it. Think of it as filler inventory, not premium placement.

The death of syndication

One underreported casualty: large aggregators.

Sites that historically won Google Discover through broad redistribution/syndication (Yahoo, AOL, etc.) are losing ground. AI doesn’t need them. It can summarize directly.

This mirrors what we’re seeing in AI Search more broadly: middlemen lose value when synthesis replaces aggregation.

Why this breaks publisher economics

This shift is not linear. It’s lumpy.

- Traffic loss happens in chunks, not gradual declines.

- Audience ownership erodes: no clicks → no email signups, no subscriptions.

- Editorial ROI becomes opaque: your content feeds AI answers or YouTube journeys you don’t monetize.

Google Discover used to be volatile but lucrative. Now it’s volatile and extractive.

As we outline in our work on AI-first discovery, visibility without controllable distribution is not a growth strategy.

So… How do you adapt?

First, build video as a defensive moat. YouTube is not optional anymore.

If Google is going to prioritize video:

- You either supply the video

- Or you subsidize someone else’s channel

Publishers who treat video as “social support” are misreading the board. Video is now Google Discover infrastructure.

Second, treat Google Discover as an experimental channel, not a growth engine.

Google Discover is in active country-by-country experimentation mode. Expect instability.

That means:

- No forecasting based on historical Google Discover traffic

- No single-point failure dependency

- No content strategy built for Google Discover alone

As we argue in our work on the new search gatekeepers, AI-driven engines reward resilient content systems, not brittle growth hacks.

Third, automate your content distribution workflow.

Using Marfeel’s Amplify tool you can post to social media, create intelligent recirculation modules, and publish your content to news feeds. All from one platform.

- Social platforms: Facebook, Instagram, Linkedin, Reddit, Bluesky

- Messaging Apps: WhatsApp, Telegram

- On-page recommenders

As Jesús Bosque from Softonic summarises:

This would explain the movements I’m seeing every time something is shared on X. I think the best advice is YouTube, but seeing as X can boost traffic, it could be a good thing for publishers in the short term. In other words, something inexpensive.

Google’s Creator Profile also references Facebook, Instagram, and TikTok suggesting these platforms may soon start flowing into Google Discover.

So, start utilizing your socials to expand your visibility across all channels.

My last thoughts

Google Discover is no longer your distribution partner. It’s your competitor for attention.

AI Summaries, YouTube, and soon other social platforms are absorbing the surface area publishers once relied on. Attribution is cosmetic. Clicks are optional.

The publishers who survive this shift will:

- Measure visibility beyond traffic

- Engineer content for AI extraction

- Diversify formats (especially video)

- Reduce platform dependency

Everyone else will keep refreshing Google Discover dashboards, wondering where the clicks went.

How Decoding helps

At Decoding, we help brands, publishers, and ecommerce adapt to AI SEO:

- AI & Discover audits to identify hidden exposure and risk

- Content creation for AI Summaries, AI Overviews, and LLMs

- Digital PR & entity building to win attribution where it still matters

- Visibility tracking across Google AI, ChatGPT, Perplexity, and beyond

If Discover is still a major line in your growth model, it’s time for a hard reset.

Leave a Reply